|

0 Comments

Cash Distribution - Sale of Megacenter Heights. Annual 22.6% IRR and 2.3X Equity Multiple11/10/2020  Megacenter Heights consisted of approximately 195,000sf located in Houston Texas, with frontage to Interstate 45. The project, acquired in 2016, was sold in 2020 to the Texas Department of transportation in an all cash transaction valued at $16.8 million. The transaction had a 4 year holding period with a remarkable annual 22.6% IRR and 2.3X Equity Multiple. "Houston Equity Partners Management is delighted with the investment results. In a very challenging year for most industries, this exit reinforces our thesis of portfolio diversification to achieve attractive risk adjusted returns even during a challenging economic environment. The transaction will boost our Porftolio's performance and will trigger a cash distribution to our members before year end that will be announced to confidentially to our members based on each partners capital account."

Thanks to our members for partnering with us.

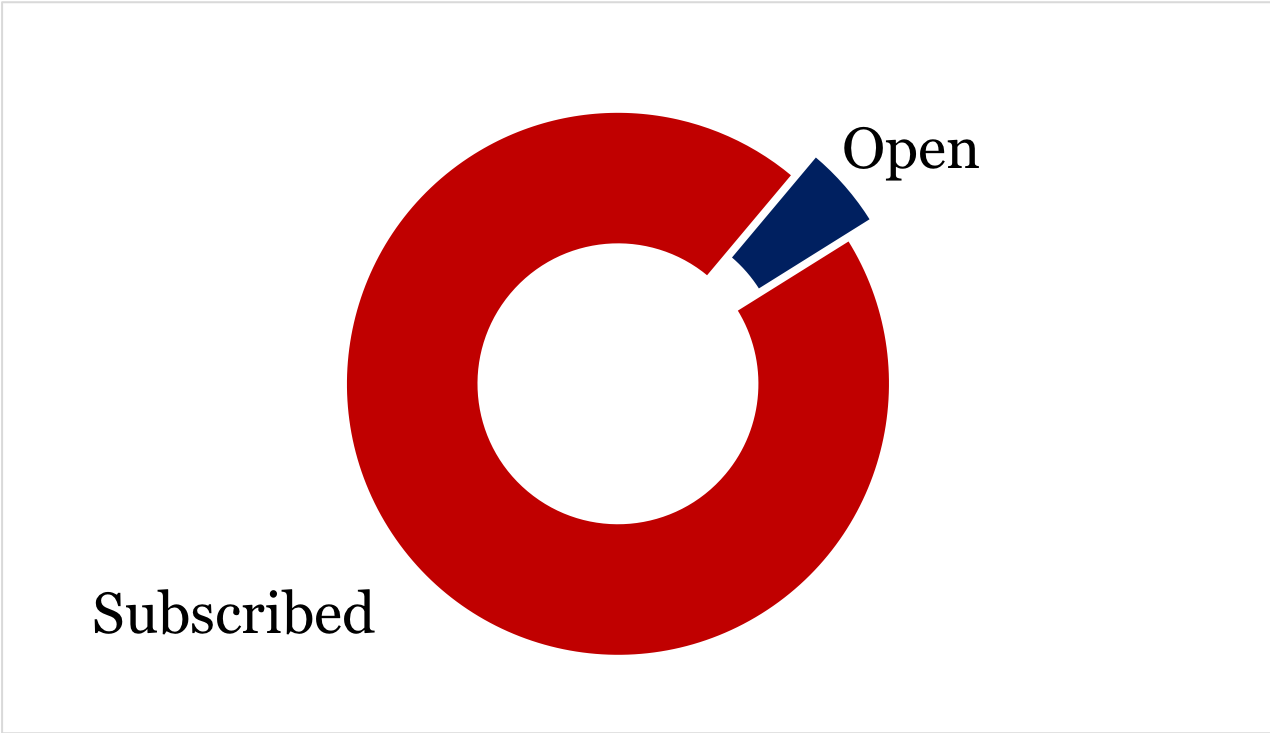

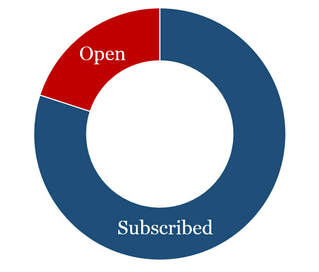

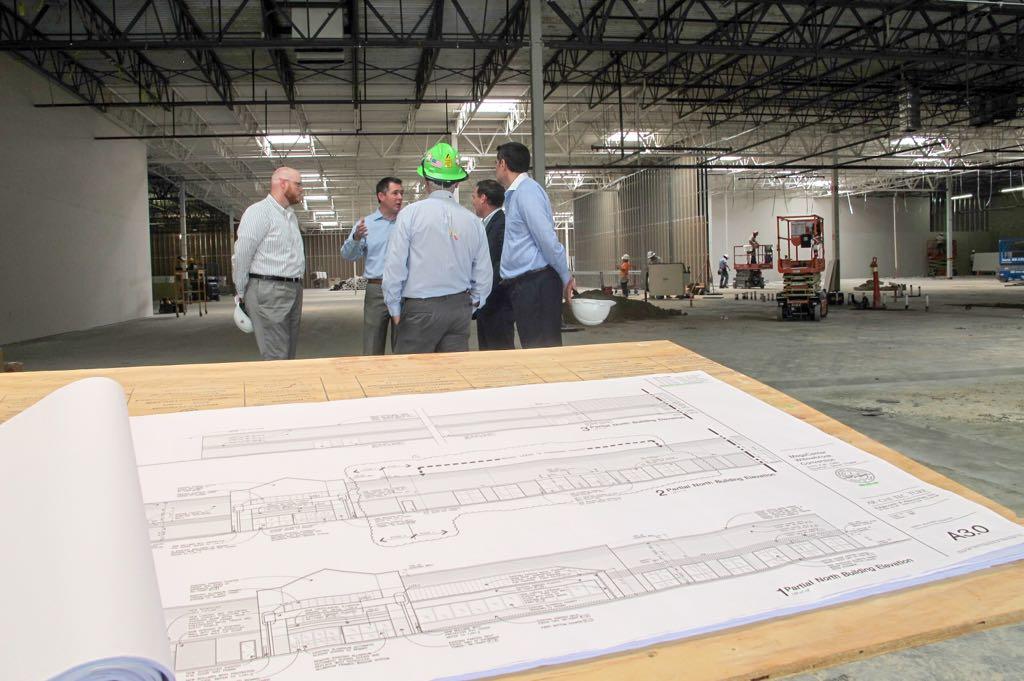

Capital raised USD 1,048,845 Prospective investors can still participate by contacting us. Houston Equity Partners is pleased to communicate that it has decided to joint venture in the project known as Megacenter Memorial located at 1530 West Sam houston Pky N, Houston Texas.

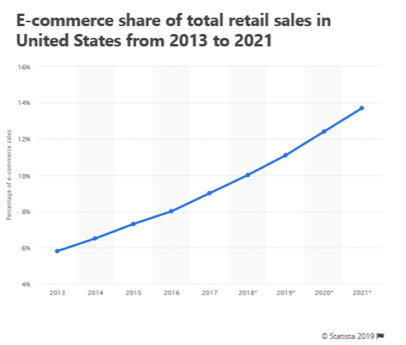

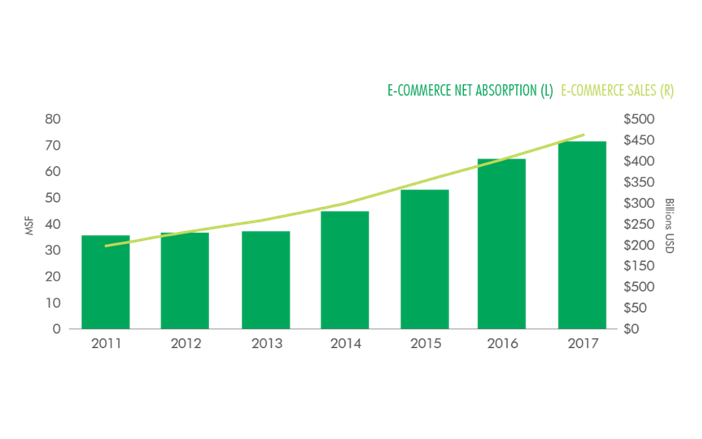

The project is a redevelopment of a former NOV facility of approximately 186,000sf. The redevelopment will consist of converting the facility in a mixed use multitenant warehouse, self storage and office facility. The cash contribution provides Houston Equity Partners 5% of the equity contributed so far.  In 2010, e-commerce retail sales in the United States made up only 4.2% of all retail sales. However, by the last quarter of 2017, e-commerce sales made up 9.1% of all retail sales. In other words, at the end of 2017, these e-commerce sales totaled over $115 billion. E-commerce’s success does not appear to be a temporary phenomenon. It is projected that e-commerce’s retail growth will continue to expand going forward. Amazon has been a major player in the success of e-commerce. In 2010, Amazon’s revenue was found to be in an excess of $34 billion, and by 2017 the e-commerce giant’s revenue grew to $178 billion. Currently, Amazon owns 43% of all e-commerce purchases undoubitably dominating the space. Amazon alone accounts for nearly half of all e-commerce sales. However, other e-commerce retailers are also contributing to online sales. The success of e-commerce is directly tied to the growth of the industrial market. According to CBRE, E-commerce accounts for almost 9% of total retail sales in the U.S. today and has been growing nearly three times faster than brick-and-mortar sales since 2010. The impact of this growth on the supply chain is profound. A hallmark of e-commerce is superior service—a nearly infinite number of choices, fast delivery and flexible return options. This pressure on the supply chain has driven demand for industrial real estate to nearly unprecedented levels and has fundamentally changed the look of the modern warehouse.  How much demand is coming from e-commerce users? Figure 1: 1.25 Million Sq. Ft. of Industrial Demand from each $1.0 Billion in E-commerce Sales Source: Forrester Research, CBRE Research, 2018. It is commonly thought that an e-commerce supply chain requires up to three times more warehouse and logistics space than a traditional brick-and-mortar supply chain. Anecdotal evidence suggests that this is true, but a recent CBRE Research study found that for each incremental $1 billion growth in e-commerce sales, an additional 1.25 million sq. ft. of distribution space is needed to support this growth. Per CBRE, this suggests that of the 236 million sq. ft. that was absorbed in 2017, approximately 30% of it was attributable to e-commerce.  How is e-commerce affecting building design? Figure 2: U.S. Average New Warehouse Building Size Source: CBRE Research, CBRE Econometric Advisors, 2017. CBRE research showed that demand for efficient logistics space that facilitates quick movement of goods to consumers has necessitated design of new warehouses that are larger in size and height. The average new warehouse in the U.S. increased by 108,665 sq. ft. (143%) in size and 3.7 feet in height when comparing high development activity periods in 2012-2017 and 2002-2007. Distribution markets that serve major population centers and have land for new warehouses saw building sizes increase the most, including Atlanta, the Inland Empire and Cincinnati. Rapidly growing e-commerce sales are the primary driver of this trend, and markets lacking sufficient modern logistics facilities have further expansion potential ahead to keep pace with this rising demand.  Megacenter US, recently announced the completion of phase one of Megacenter Willowbrook, asset among HEP equity investments with 235,627-square-foot mixed-use project comprised of industrial flex, self storage, retail and office space in northwest Houston, Texas. The project, which broke ground earlier this year, has completed its first phase consisting of 37,000 square feet of flex warehouse; 20,000 square feet of self storage; and 15,000 square feet of office suites and co-working space. Additionally, the property will have a 114,000-square-foot gym and 34,000 square feet of entertainment destinations. Currently 75 percent of the building is leased to a variety of tenants, including one of the largest e-commerce retailers worldwide (Amazon),national entertainment tenant 13th Floor Entertainment Group (operator of haunted houses and escape rooms); Focus Physique Fit (fitness center); PGE (printing and retailer); Unimech Flow Inc (valves distributor); and multiple small warehouse and office tenants. Phase two has been leased for the redevelopment of a 114,000-square-foot fitness center with an expected completion date by summer of 2019. The space will contain a restaurant, soccer and basketball courts, baseball batter box and a full fitness center. “We are very pleased with the market response to our mixed-use development concept”, Project Management commented. “Small flex warehouse spaces (under 4,000 square feet), combined with executive office suites and self storage, provide flexible solutions to small businesses, which are the bulk of our customer base. We believe the ecommerce shift in the retail economy has been an important factor to the acceptance of our product mix, with Amazon being among the main tenants at this location. Megacenter Willowbrook product mix allows small- and mid-size businesses to grow in our business parks without having to relocate. The addition of multiple entertainment tenants (fitness center, escape rooms and haunted house) bring an enjoyable place to work that not only impacts our project but also the community around Megacenter Willowbrook.” Situated on 24 acres at 7075 FM 1960 about 23 miles northwest of downtown Houston, the property is across the street from Willowbrook Mall, a 1.45 million-square-foot regional mall with more than 19 million annual shoppers, an in an affluent area of Houston with 103,630 residents earning an average household income of $89,102 within a three-mile radius.

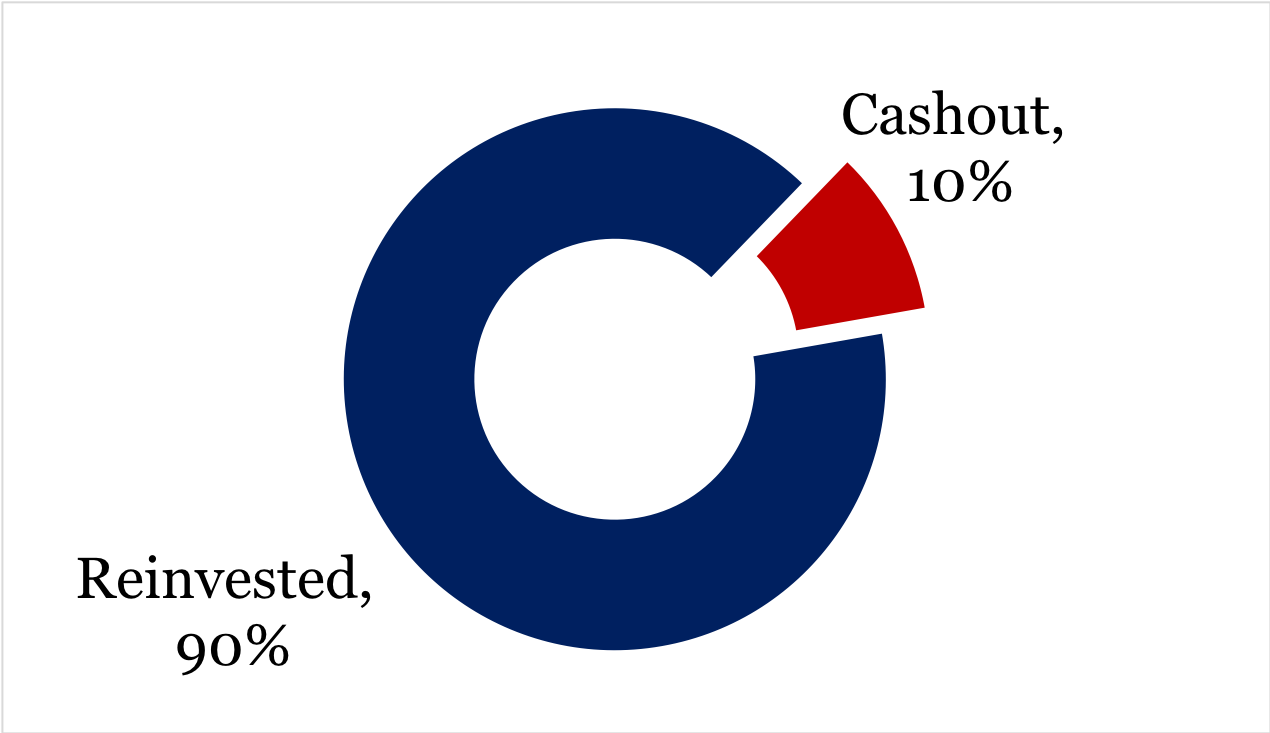

A refinance event or also commonly called investor’s cash-out, is a transaction that allows the investor to withdraw equity in the form of ‘cash’ from an asset owned by the investor. After a cash-out, the investor may re-invest in new properties to keep building wealth or diversifying a portfolio.

The simplest example is a residential home refinance. The investor buys a property for $100, after some time, market prices go up say 25%, with the property value increasing to $125. If the investor refinances 80% of the property value, he would be able to pull out the original $100, while still owning the property. The $100 might be used to invest in a new property or any other use. Commercial real estate prices are not as market-driven as residential real estate. In commercial real estate, market prices are mainly determined by the net operating income (NOI) that the property generates and the market Capitalization Rates (Cap Rate). The NOI is the bottom line of the commercial real estate rental business. In few words, NOI is sales (rental revenues) minus operating costs. The NOI can be improved through a professional property management which increases occupancy and/or rental prices; and/or reduces costs (insurance, maintenance, staff, etc.) The Cap Rate is the NOI divided by the property sales price. The capitalization rate indicates the rate of return that is expected to be generated on a real estate investment. As an example, if the property’s NOI is $100 and the property asking price is $1,000 its cap rate is 10%. Similar to a bond, a lower cap rate renders a higher valuation. Now, taking the previous example to the Commercial Real estate arena. If an investor purchases a warehouse for $1,000 with NOI of $100 (10% cap rate), if after a given time the investor manages to increase the NOI by say 35%, assuming that Cap Rate is still 10%, now your property value is $1,350. Therefore, if the property is refinanced with a bank willing to lend say 75% of property value, the investor would be able to pull out ~$1,000 as a cash-out, while keeping the property operating and generating income. Investors can then re-invest this cash in different projects. Refinance is a simple mechanism. However, timing is as critical as having an appealing NOI. Prevailing Interest rates and lending options, due to global, domestic and market economy conditions, are also part of the equation. These variables might reduce the loan amounts or increase financial costs delaying the refinance until better market conditions. In conclusion, a re-finance is an attractive strategy to build equity. However, it cannot be achieved without experience and a professional Real Estate management team, which sources properties at attractive entry prices, has a network of lending institutions and the experience to improve Net Operating Income. Legal Disclaimer: This information is provided for educational purposes only. Readers of this article must consult a qualified professional in their jurisdiction for all opinions for their specific situation.

Houston Equity Partners Management is always excited about adding new relationships to our company.

In a few months after the Round B-3 started:

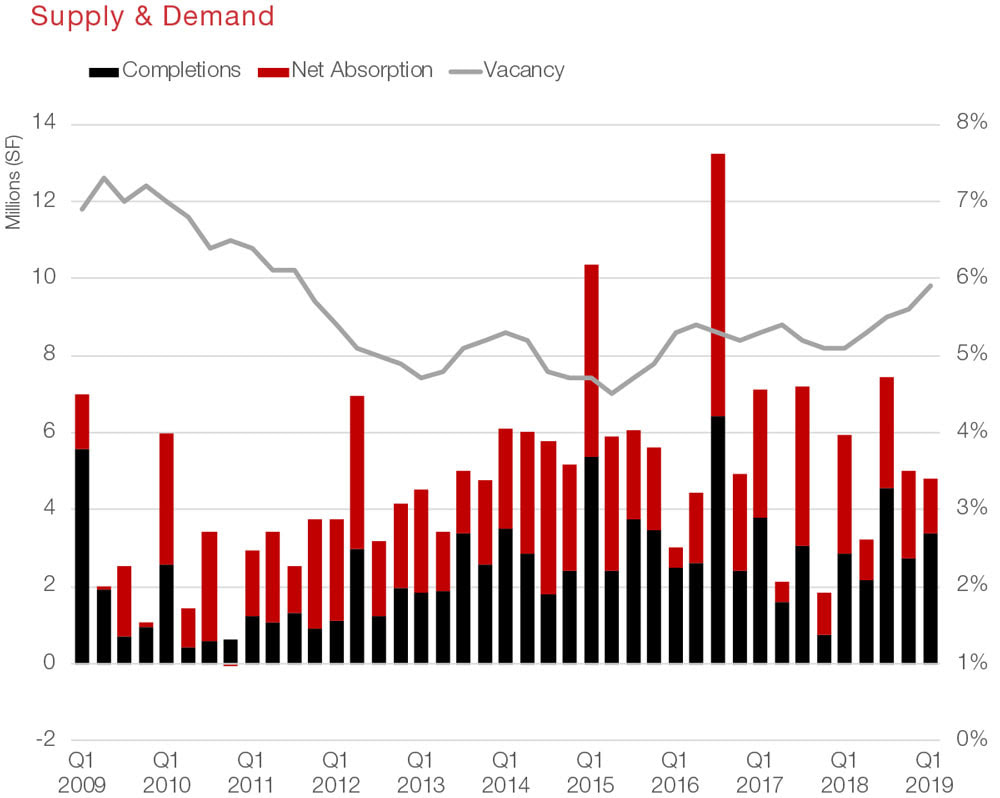

Houston Industrial | Q1 2019 | Quarterly Market Report - SOURCE: NAI Partners

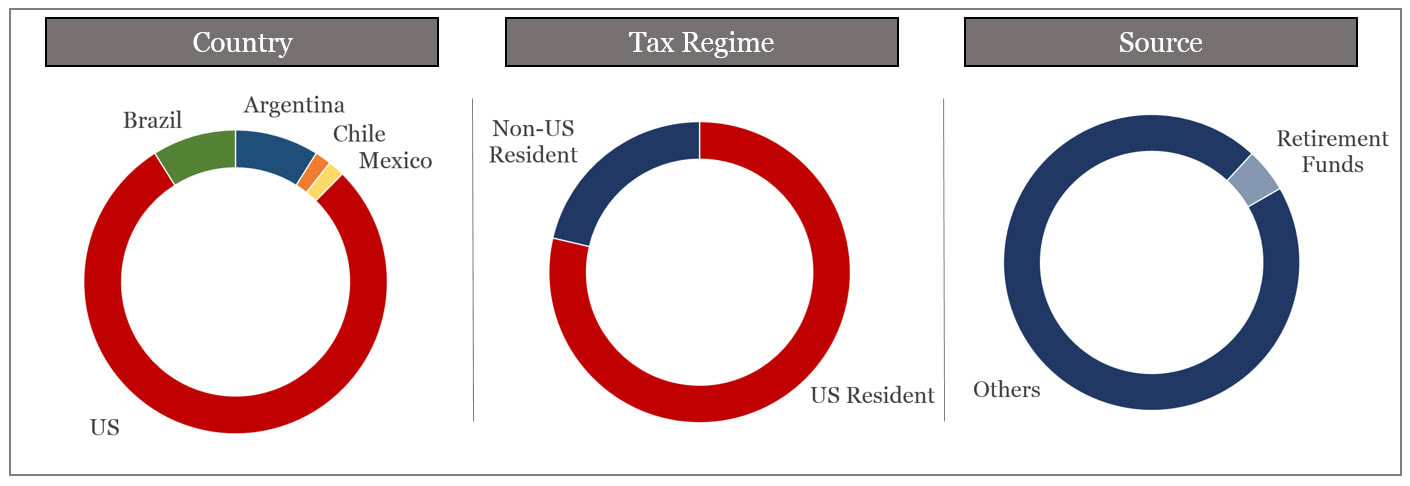

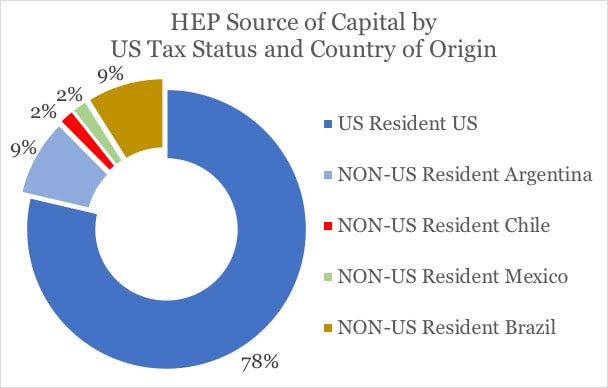

Metro Houston created 72,600 jobs, a 2.4% increase, in the 12 months ending February 2019, compared to 56,400 jobs created in the 12 months ending February 2018, a 1.9% increase, according to the Texas Workforce Commission. The three sectors adding the most jobs over the past 12 months were durable goods manufacturing (15,200); professional, scientific and technical services (12,800); and health care (10,300). In energy, exploration and production lost 300 jobs while oil field services added 3,600. Energy prices recovered over the first quarter from year-end 2018. 2019 began with West Texas Intermediate trading at $46.31 a barrel, trending up through Q1 2019, and closing on the last day of March at $60.19 per barrel, a 30.0% increase. While oil prices recovered, Baker Hughes reports that the U.S. rig count peaked at 1,083 the last week of December and trended down in the first quarter of 2019. The rig count typically responds to fluctuations in monthly oil prices with a three-month delay. At the end of the first week in April, the rig count was at 1,025. Softness in the rig count suggests less work for oil field service firms now and slower U.S. production growth in the future. The unemployment rate in Houston was 4.1% in February, compared to the rates in both Texas and the United States at 3.8%. Record-breaking development pipeline Houston’s overall industrial vacancy rate ended Q1 2019 at 5.9%, up 30 basis points quarter-over-quarter, and an increase of 80 basis points year-over-year. Net absorption was 1.4 million sq. ft. for the first quarter of 2019, down 44.2% over the prior year’s 3.1 million sq. ft. New construction delivered during the first quarter stood at 3.4 million sq. ft.—up from the fourth quarter’s 2.7 million sq. ft. There is currently a record-breaking 16 million sq. ft. under construction, with the lion’s share in the Southeast (5.8 million sq. ft.) and North (5.4 million sq. ft.). Triple net average monthly asking rents remained at $0.60 per sq. ft. quarter-over-quarter, and up 7.1% from $0.56 year-over-year.  Foreign nationals typically face more restrictions than US-residents when applying for credit or investing in US Real Property in the United States. Access to Credit and leverage is a significant constraint since financial institutions typically allocate a high credit risk to non-US Individuals or entities, therefore requiring higher real estate interest rates and longer approval processes. An alternative to simplify investing in US Real Property is considering private equity investments through an entity already established in the US. An LLC (Limited Liability Company) established in the US can be a useful instrument to pull capital and resources ultimately simplifying the investment process for Non-US investors. Typically, an LLC is treated as a “pass-thru” partnership, in which its income is allocated among its partners or members (the investors). The tax process for non-US residents is relatively simple. Non-US residents typically would need to obtain an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service and report its US-based income once a year. Taxes are paid over the profit generated by the LLC. The LLC uses the current maximum tax rate to withhold a portion of the funds being distributed to non-US resident member, which currently stands at ~37%. At the end of the year, after the Non-US investor files its tax return, the actual tax rate is calculated based on all his sources of US income. It is reasonable to expect the actual tax rate to be lower than 37% (visit https://www.irs.gov/pub/irs-pdf/i1040tt.pdf for current rates). The difference between the tax withheld and the actual tax liability is refunded to the non-US investor. Houston Equity Partners LLC, is an example of an entity that manages several US and Non-US Investors globally, providing access to US Real Estate Investments to qualified investors from the US, Mexico, Argentina, Chile and Brazil.  Using retirement funds to invest in real estate offer retirement account holders several positive financial and tax benefits: 1) understanding of the asset and business model, 2) diversification, 3) inflation hedge, and 4) the ability to generate tax-deferred or tax-free (in the case of a Roth) income or gains. For example, if a person acquired a piece of property with retirement funds for $100,000 and later sold the property for $200,000, the $100,000 of gain appreciation would generally be tax-deferred. Whereas, in the case of personal funds (non-retirement funds), the gain would be subject to federal income tax and in most cases state income tax. However, most people mistakenly believe that their retirement accounts must be invested in traditional financial related investments such as stocks, mutual funds, exchange traded funds, etc. Few Investors realize that the Internal Revenue Service (“IRS”) permits retirement accounts, such as an Self-directed IRA or 401(k) plan, to invest in real estate and other alternative types of investments. If your employer 401(k) plans do not offer real estate as a plan investment option, establishing a self-directed IRA is quick and relatively inexpensive. The most challenging aspect of investing in real estate using retirement funds is navigating the IRS prohibited transaction rules (Internal Revenue Code Section 4975) that prevent the retirement account holder from making investment that will directly or indirectly benefit ones self or any disqualified person. In order to comply with regulations and understand what instruments are suitable, you should always consult with a tax professional for further guidance and have a paid custodian to keep track of and reports to the IRS on deposits, withdrawals, and year-end balances related to your investments. Houston Equity Partners Offering approved for IRA (401k, etc.) Investing We are glad to inform that it is now possible to invest Retirement/IRA (401k, etc.) money directly into Houston Equity Partners - Round III. Madison Trust Company (www.madisontrust.com) - who specializes in Private Investments and Non-publicly-traded funds- has approved the offering as a qualified Alternative Investment. The process is simple: 1) Madison opens a new (Self-Directed) IRA for you. 2) Madison helps you transfer – all or A portion of – your existing retirement money to your new IRA. 3) Madison invests your new IRA directly into our Fund. The fees would be as follows:

Megacenter Westway Business Park reaches 94% occupancy amid ~20% rent revenue increase after completion of 2 year value add program. "Houston Equity Partners Management is pleased with the results of the capital improvements carried out at Westway by our development partner Megacenter US. Investments in reducing unit sizes have allowed to capitalize on an under-served market of under 2500sf in the energy corridor. This good lease-up momentum leaves the asset ready for a planned cash out refinance in 2019...".

Lease-up momentum favorable. Developer Megacenter US, with local group Houston Equity Partners, sees completion of phase 1 construction of 235,000sf Willowbrook Business Park at 7075 FM 1960, Houston TX. Good Lease-up momentum brings occupancy over 65% ahead of budget. Prominent tenants include Amazon.com, 13 Floor Entertainment Group, ChickFillA, and multiple medium size Industrial tenants. Facility includes Industrial Flex Space, Office Suites and Self Storage to serve small, medium and large tenants.

Developer Megacenter US, in partnership with Local Real Estate Group Houston Equity Partners LLC, has completed redevelopment of 110,000sf Katy Industrial and Retail Center at 510 S Mason Drive, Katy Texas. "The facade enhancement is the final step in a successful 2 year Value add investment program leaving the property ready for a planned refinance in 2019", Houston Equity Partners Management commented.

Megacenter US, Houston Equity Partners, Icon Bank, HFF and Slate Construction break ground at massive 235,000sf Industrial & Self Storage Business Park. Ground breaking of 235,000sf Industrial, Self Storage and Mixed use development in north west Houston. Developer Megacenter, Houston Equity Partners, Icon Bank, HFF, and General Contractor Slate Construction participated in the massive development.

A former Walmart Supercenter across from Willowbrook Mall is being redeveloped into a 235,627-square-foot mixed-use project.

Megacenter U.S., a subsidiary of Red Megacentro, broke ground earlier this year on the first phase of Megacenter Willowbrook, located on 24 acres at 7075 FM 1960. A 113,940-square-foot gym; 47,319-square-foot of industrial flex space and a 6,810-square-foot auto center is expected to be finished in Nov. 2019. The second and third phases will consist of self-storage and office space totaling 49,193 square feet and 25,266 square feet, respectively. HFF debt placement team brokered financing for the redevelopment project, Megacenter's fifth in the U.S. The three-year, floating rate loan with Icon Bank will be used to fund the project's construction. Megacenter has more than 40 locations throughout Chile, Peru, South Florida and Texas. https://www.chron.com/business/retail/article/Mixed-use-project-to-replace-former-Walmart-in-13120807.php#photo-15946134 |

|

H O U S T O N E Q U I T Y P A R T N E R S

HEP allows Accredited Investors the opportunity to invest in Industrial, Commercial, Self-storage and Mixed Use income producing assets, strategically located throughout the Greater Houston Area.

|

M E N U

|

C O N T A C T U S

Corporate Offices

2313 West Sam Houston Parkway N Houston, TX 77043 Inquiries: 281-899-0579 Investor Relations: 281-817-6342 Email: [email protected] |

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed