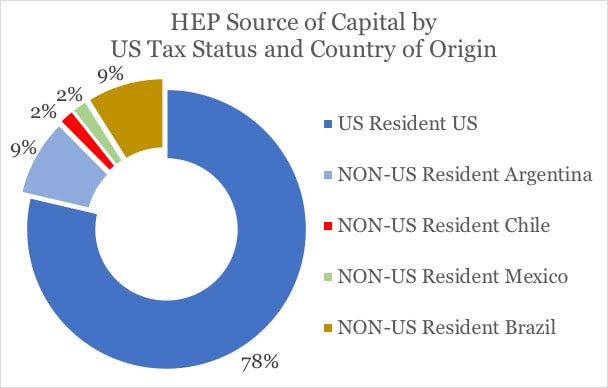

Foreign nationals typically face more restrictions than US-residents when applying for credit or investing in US Real Property in the United States. Access to Credit and leverage is a significant constraint since financial institutions typically allocate a high credit risk to non-US Individuals or entities, therefore requiring higher real estate interest rates and longer approval processes. An alternative to simplify investing in US Real Property is considering private equity investments through an entity already established in the US. An LLC (Limited Liability Company) established in the US can be a useful instrument to pull capital and resources ultimately simplifying the investment process for Non-US investors. Typically, an LLC is treated as a “pass-thru” partnership, in which its income is allocated among its partners or members (the investors). The tax process for non-US residents is relatively simple. Non-US residents typically would need to obtain an Individual Taxpayer Identification Number (ITIN) from the Internal Revenue Service and report its US-based income once a year. Taxes are paid over the profit generated by the LLC. The LLC uses the current maximum tax rate to withhold a portion of the funds being distributed to non-US resident member, which currently stands at ~37%. At the end of the year, after the Non-US investor files its tax return, the actual tax rate is calculated based on all his sources of US income. It is reasonable to expect the actual tax rate to be lower than 37% (visit https://www.irs.gov/pub/irs-pdf/i1040tt.pdf for current rates). The difference between the tax withheld and the actual tax liability is refunded to the non-US investor. Houston Equity Partners LLC, is an example of an entity that manages several US and Non-US Investors globally, providing access to US Real Estate Investments to qualified investors from the US, Mexico, Argentina, Chile and Brazil.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

|

H O U S T O N E Q U I T Y P A R T N E R S

HEP allows Accredited Investors the opportunity to invest in Industrial, Commercial, Self-storage and Mixed Use income producing assets, strategically located throughout the Greater Houston Area.

|

M E N U

|

C O N T A C T U S

Corporate Offices

2313 West Sam Houston Parkway N Houston, TX 77043 Inquiries: 281-899-0579 Investor Relations: 281-817-6342 Email: [email protected] |

© COPYRIGHT 2015. ALL RIGHTS RESERVED.

RSS Feed

RSS Feed